What is the process for reimbursing home charging sessions to my employees?

The system for reimbursing your employees’ home charging sessions has recently changed. A "Call for funds for the reimbursement of expenses claims" has now replaced the former invoicing process leading to reimbursement.

This change will enable to:

- guarantee the legality of the proposed system,

- lay the foundations for a more efficient system,

- prevent your employees from being taxed on the reimbursements they receive for charging their company cars.

How does it work?

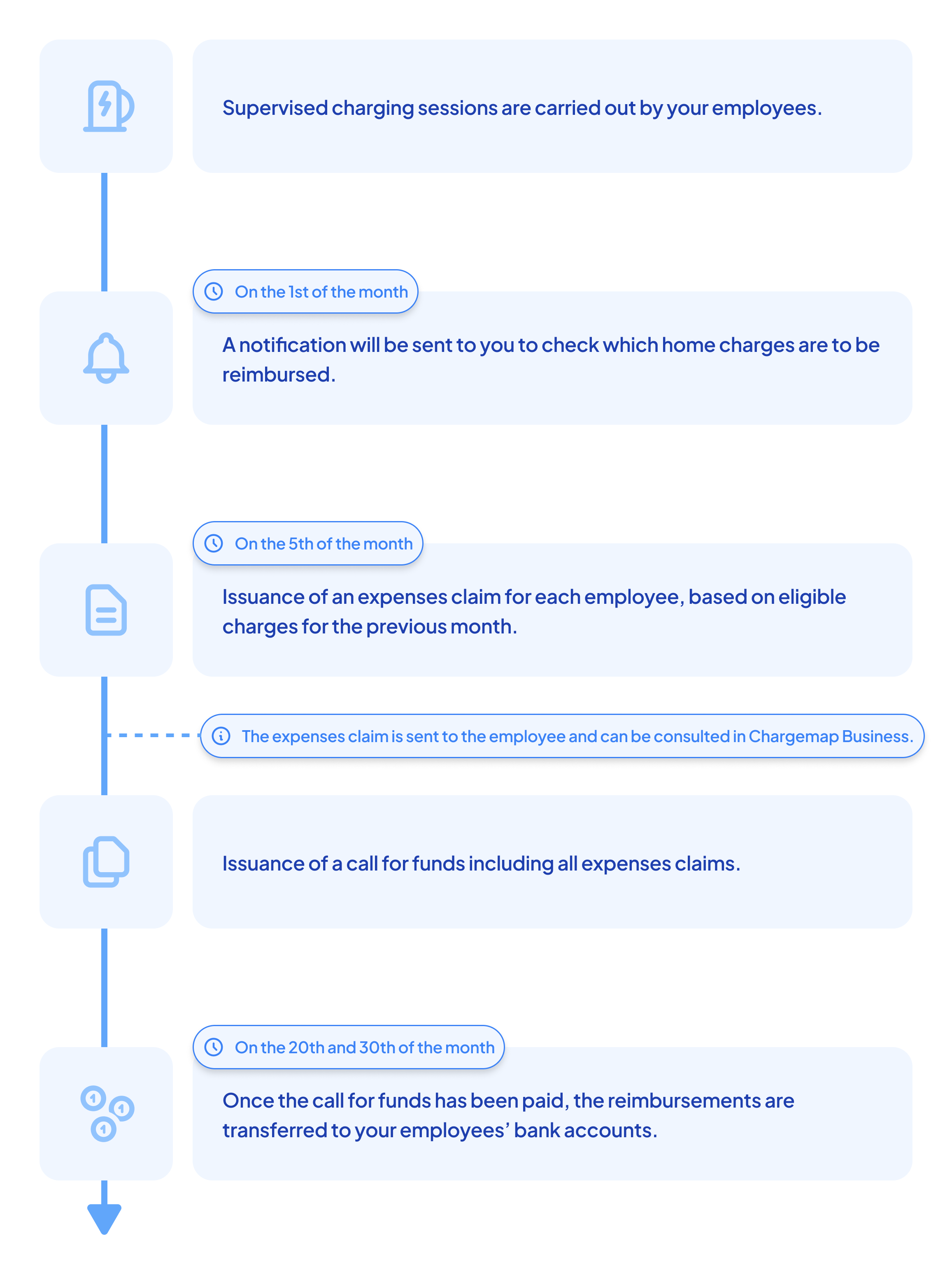

The system comprises 3 key stages:

- On the 1st of the month, Chargemap Business sends you a notification inviting you to check the correct status of home charging reimbursements.

- On the 5th of the month, Chargemap Business issues an expenses claim for each employee for the charges eligible for reimbursement. A call for funds containing all these expenses claims is sent to you. You can find the details of the expenses claims in your Chargemap Business management interface.

- On the 20th and 30th of the month, if the call for funds has been paid, the reimbursements are transferred to your employees' bank accounts.

Here is a visual representation of the refund process:

Management of accounting documents

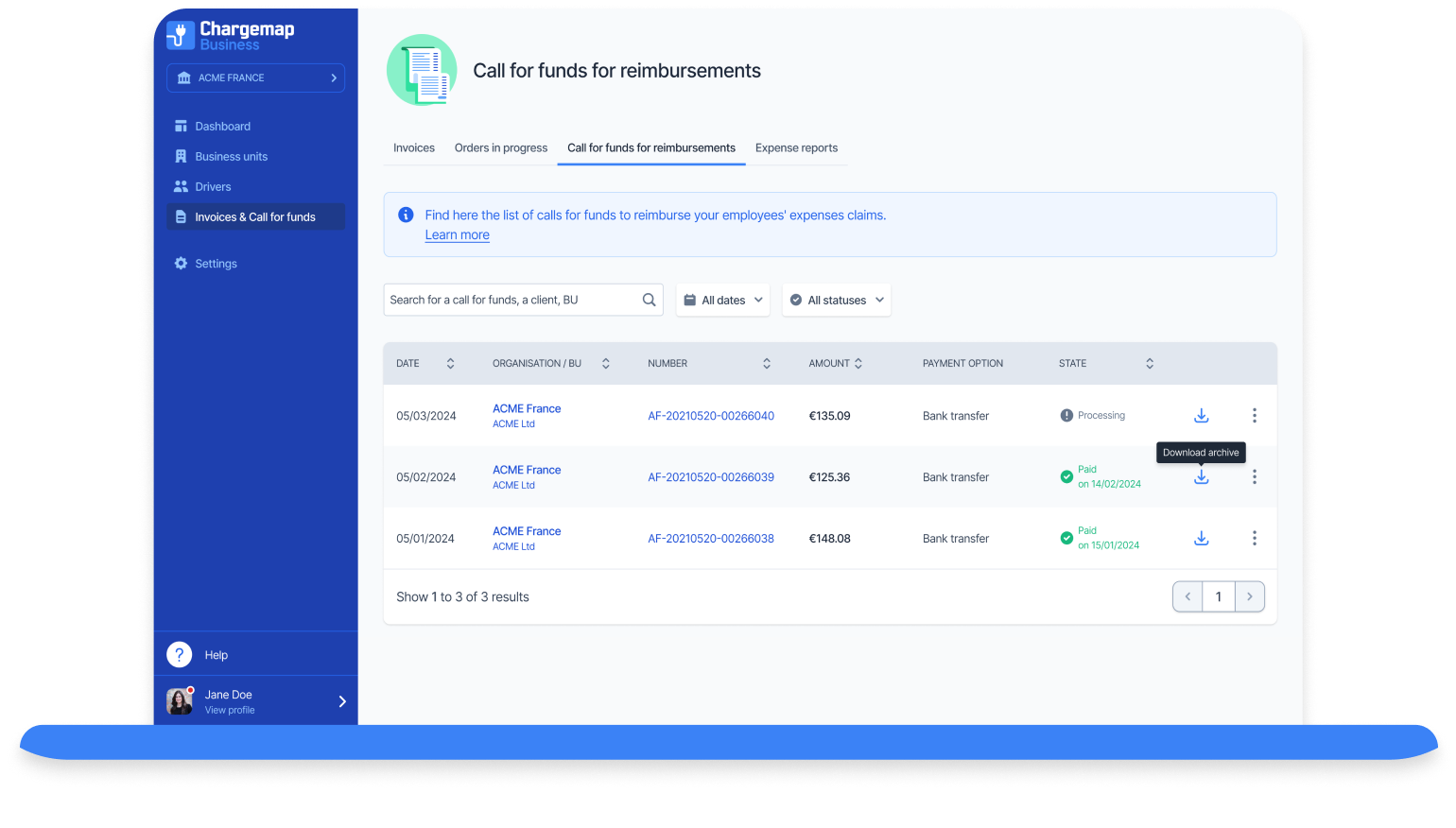

Expenses claims, calls for funds and the list of eligible charges can be accessed from your Chargemap Business interface. Go to the 'Invoices & calls for funds' tab and then to ‘Calls for funds for reimbursements'.

You can then 'Download the archive' of each call for funds. You'll find all the accounting documents in pdf, csv and excel formats, which you can then integrate into your accounting management tools. This archive will also contain the reimbursement receipts sent to each employee.

FAQ

Under which conditions is a charge “eligible for reimbursement”?

A charging session is included on an expenses claim issued on the 5th of the month if it:

- is identified in Chargemap Business as "To be reimbursed" (can be modified in the Chargemap Business interface up to the issue date)

- was carried out up to the last day of the month before the issuance of the expenses claim

- has not been identified as a "suspicious" charge (with inconsistent data that is under investigation)

- has not already been included in an expenses claim

How often are your employees reimbursed for expenses?

For an expenses claim to be reimbursed, the Call for Funds on which it appears must first be paid.

Reimbursements are then made on the 20th and 30th of each month.

What is the payment deadline for calls for funds?

The payment deadline for Business Unit invoices is also applied to calls for funds. If your deadline is set at 30 days, your employees will not be reimbursed for charges before this deadline. They will therefore receive the reimbursement as of the 20th of the following month.

NB: The payment method is the same as that used for paying charging session invoices.

How do you identify an expenses claim and a call for funds?

An expenses claim and a call for funds each have a specific number. The number of the expenses claim can be found on the call for funds recap.

Should you require any further assistance concerning reimbursement issues, please contact your account manager.